Original Title: The Stablecoin Trap: Issuing a Stablecoin Without the Infrastructure to Run One

Original Author: Kash Razzaghi, Circle

Compiled by: Peggy, BlockBeats

Editor's Note: As regulatory clarity improves and institutional participation increases, stablecoins are evolving from technical tools into critical financial infrastructure. This article points out that issuing a stablecoin is not merely a technical choice but a long-term strategy centered on trust, liquidity, and compliance capabilities. Most projects fail to scale, and the market is naturally converging toward a few mature networks. For most businesses, the real question is not "whether to issue a coin" but "how to effectively use stablecoins" to create growth opportunities for their operations.

Below is the original text:

In recent months, I have repeatedly had familiar conversations with executives from some of the world's largest companies. They have shown strong interest in stablecoins like USDC and EURC—digital versions of the US dollar and euro—that enable near-instant, cross-border transfers. Many of them are also considering: Should we issue our own stablecoin?

This impulse is understandable. The market has already achieved significant scale and sustained growth momentum. In 2025, the total market capitalization of stablecoins grew from approximately $205 billion on January 1, 2025, to over $300 billion by December 31, 2025. USDC, issued by Circle, remains one of the core assets in this category, closing out 2025 with a market cap exceeding $75 billion.

However, before entering the market, every company should first ask itself: Do you simply want to use stablecoins for your business, or do you intend to enter the "business of issuing stablecoins"?

This is not a technical question but a strategic one: Is issuing currency a core part of your business model?

Relatively speaking, creating a stablecoin on a blockchain is the easiest part. Essentially, it is a software engineering exercise: writing and deploying a token contract on a blockchain. With an engineering team or, in some cases, leveraging white-label partners, a token can be launched in a relatively short time. But once the product is live, operating a stablecoin means supporting a 24/7 financial infrastructure.

To operate a trusted, regulated stablecoin—one that meets the expectations of institutions, regulators, and millions of users—requires real-time reserve management across different market cycles, daily reconciliation with multiple banking partners, independent audits, and compliance and regulatory reporting across multiple jurisdictions. This means building round-the-clock compliance, risk management, treasury management, and liquidity operations systems, with clear escalation and resolution mechanisms in stress scenarios and zero tolerance for errors. These capabilities are not something that can be "outsourced once and forgotten"; as scale increases, they accumulate and amplify in cost, complexity, and reputational risk.

From a systemic perspective, each new, closed-loop proprietary stablecoin further fragments liquidity and trust. Each issuer is redundantly building reserves, compliance systems, and redemption channels, ultimately weakening the overall depth and resilience that stablecoins rely on during times of stress. In contrast, integrating USDC allows for the consolidation of liquidity, standards, and operational capabilities into a widely adopted, unified network from day one.

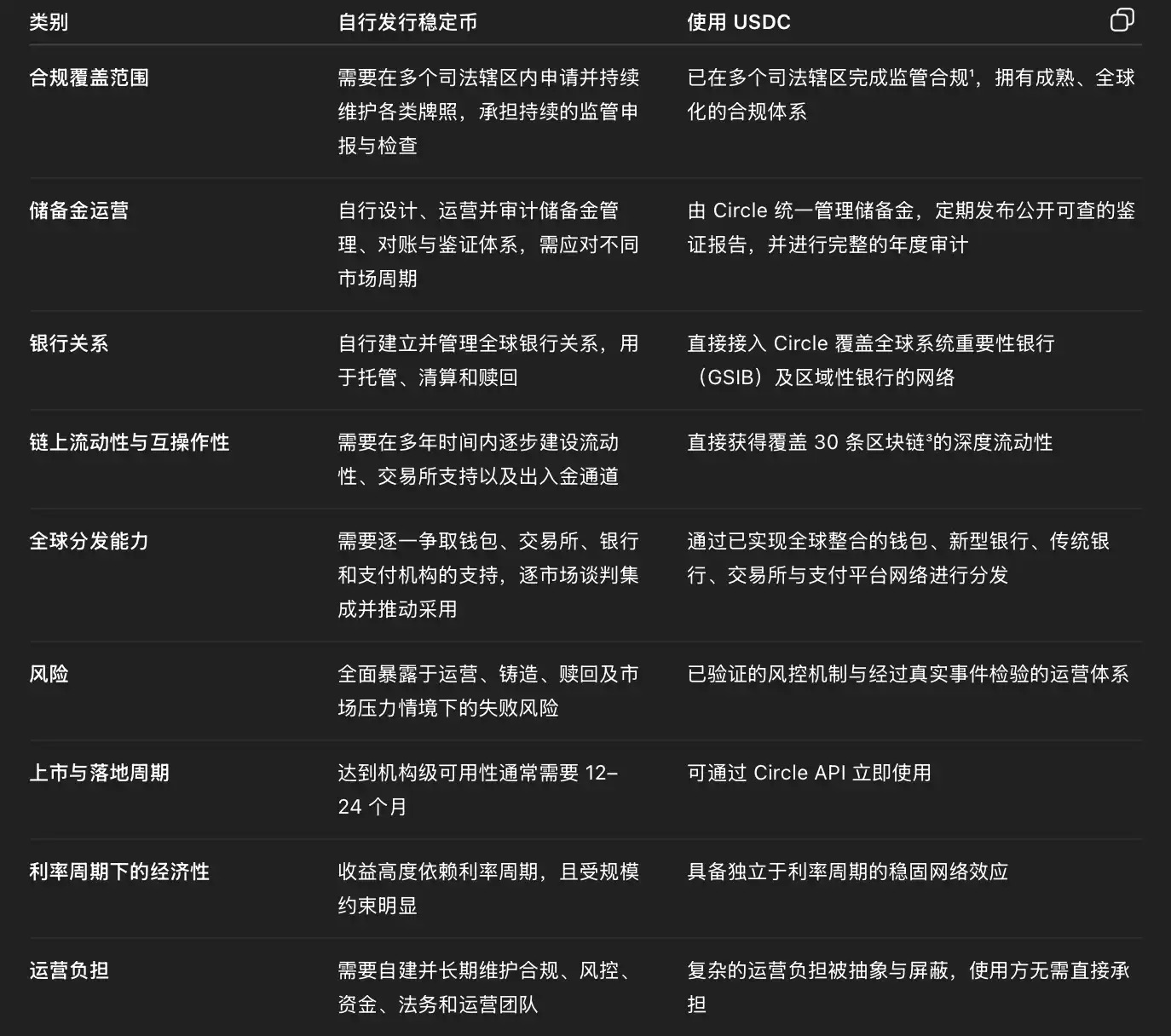

For corporate executives evaluating this decision, the differences between these two paths become particularly clear when viewed from an operational perspective:

The Temptation of Shortcuts

Currently, a wide range of newcomers—from fintech companies and payment institutions to crypto projects—are exploring or directly launching their own stablecoins. The growth of the stablecoin market in 2025 reflects both the gradual clarity of the regulatory environment and rising institutional interest. But the reality is that, although hundreds of stablecoin projects have been launched, about 95% have never achieved lasting, global scale.

Some believe it is possible to replicate the same economic returns without bearing the heavy operational costs. The reality, however, is not so romantic. Whether issuing a stablecoin on your own or through a white-label service, you are entering an industry where trust, liquidity, and scale are matters of survival.

Sometimes, the cost of mistakes is measured in "trillions." According to media reports earlier this year, one issuer accidentally minted 300 trillion tokens due to an operational error. Although it was fixed within minutes, it was enough to make headlines. On another occasion, a well-known stablecoin briefly depegged during a period of extreme market volatility, again demonstrating that even minor infrastructure flaws can be amplified and transmitted under pressure.

These incidents serve as reminders that the viability of a stablecoin depends on operational rigor in high-pressure environments. Markets and policymakers are watching closely.

Trust Is the Real Network Effect

Anyone can create a token on a blockchain. In fact, thousands already exist—most minted in minutes and forgotten just as quickly. Even in the stablecoin niche, over 300 projects have been launched, but only a handful carry almost all real-world usage and value; the vast majority, about 95%, have never truly succeeded.

The difference lies not in technology but in scale and trust. The real challenge for stablecoins begins during the expansion phase: how to sustain liquidity, redeemability, compliance, and system availability as transaction volumes grow across different markets and cycles.

You can mint a token in minutes, but you cannot mint trust in minutes. Trust stems from transparency, scale, and consistent redeemability across market cycles, accumulating over time. This is why the stablecoin market has ultimately concentrated in the hands of a few issuers—and why, as of January 30, 2026, USDC's cumulative historical settlement volume has exceeded $60 trillion.

Rather Than Reinventing the Wheel, Choose Collaboration

For most businesses, the right question is not "How should we issue our own stablecoin?" but "How can we integrate stablecoins into our business to unlock new growth?"

With USDC and EURC, companies can today embed digital dollars and euros, gaining near-instant settlement, global reach, and interoperability across dozens of blockchains, without having to bear the complexities of reserve management and regulatory compliance themselves.

Writing the Next Chapter Together

The stablecoin industry is entering a new phase. Policymakers are establishing clearer rules, institutions are raising their standards, and the market is gradually converging on a simple consensus: trust, liquidity, and compliance are the real moats.

The goal is not to have more stablecoins but to have fewer and better ones—ones that can meet current demands with shared liquidity, transparent reserves, and proven performance across cycles.

For institutions formulating their stablecoin strategies, the first step should not be to decide "what to build" but "whom to build with." If you want stablecoins to empower your business but do not want to become a stablecoin issuer yourself, the time-tested choice is clear: talk to Circle and use USDC.